The creator economy has reshaped nearly every industry, including finance. Investment advice now competes for attention alongside entertainment, lifestyle content, and viral trends. As a result, regulation of financial influencers has emerged as a necessary safeguard rather than an optional policy discussion.

According to AWISEE, “Influencer marketing rules regulations are no longer optional reading for brands.” Many financial influencers genuinely aim to educate their audiences. However, the line between education and promotion is often blurred. Paid partnerships, affiliate links, and performance claims can easily mislead followers if disclosures are unclear. Regulators view this as a systemic risk, particularly for younger and inexperienced investors.

This article examines how regulation of financial influencers is enforced by the SEC and FINRA. It explains which rules apply, how firms are held accountable, and why crypto promotions attract heightened scrutiny. By grounding the discussion in real cases and regulatory guidance, this guide provides a clear picture of what compliance looks like in 2026.

What Counts as a “Financial Influencer” Under Securities Law?

There is no single legal definition of a finfluencer. And that is part of the regulatory challenge. Regulators do not care about your follower count. They care about your impact on investor behavior.

If your content influences how people buy, sell, or hold securities, financial influencer regulation begins to apply, regardless of platform or audience size.

Run Financial Influencer Campaigns Without Regulatory Risk

AWISEE provides influencer marketing services designed to meet SEC anti-touting rules, FINRA supervision standards, and FTC disclosure requirements—so brands can scale confidently without exposure.

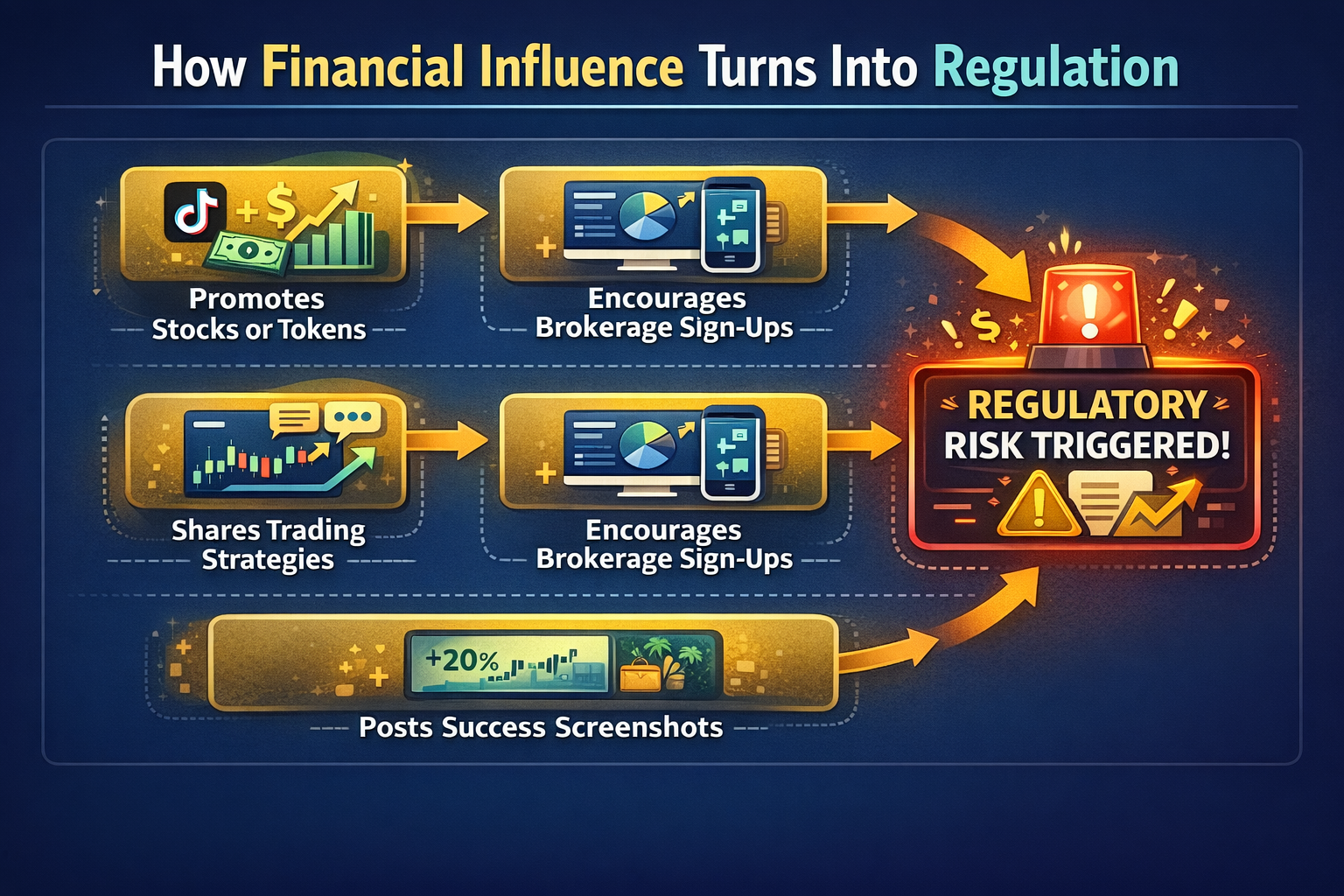

How Influence Turns Into Regulatory Exposure

A financial influencer typically does one or more of the following:

- Promotes stocks, crypto tokens, or investment products

- Shares trading strategies or “setups”

- Encourages followers to open brokerage accounts

- Posts performance screenshots or lifestyle signals tied to investing

- Uses affiliate links tied to financial products

Once money, expectations, or securities enter the picture, regulation of financial influencers becomes unavoidable.

Why Social Media Raises Investor Protection Risks

Social platforms reward confidence, not caution.

They reward certainty, not nuance.

They reward emotion, not disclosure.

According to the SEC Investor Advisory Committee, a large share of younger investors now rely on social media for investment information, even though many finfluencers lack formal qualifications or licensing.

That gap between influence and accountability is exactly what regulation of financial influencers is designed to close.

SEC vs. FINRA: Who Regulates Financial Influencers?

Understanding regulation of financial influencers starts with understanding who enforces it.

In the United States, two regulators dominate finfluencer regulation:

- The Securities and Exchange Commission (SEC)

- The Financial Industry Regulatory Authority (FINRA)

They do different jobs.

But they often work together when regulated financial promotions are involved.

What the SEC Does

The SEC is a federal regulator created after the Great Depression.

Its mission is simple:

- Protect investors

- Maintain fair markets

- Prevent fraud and manipulation

The SEC enforces major laws that directly shape SEC rules for financial influencers, including:

- Securities Act of 1933

- Securities Exchange Act of 1934

- Investment Advisers Act of 1940

If a finfluencer is misleading investors, hiding compensation, or manipulating markets, SEC finfluencer rules almost always come into play.

What FINRA Does

FINRA is not a government agency. It is a self-regulatory organization operating under SEC oversight.

FINRA regulates:

- Broker-dealers

- Brokerage firms

- Registered representatives

When firms use influencers to attract customers, FINRA rules for influencers apply directly. FINRA focuses heavily on:

- Communications with the public

- Supervision of marketing

- Recordkeeping and compliance controls

This distinction matters because many financial influencer regulation cases involve firms, not just creators.

Core SEC Laws That Apply to Financial Influencers

The SEC does not need new legislation to enforce investment influencer regulation. Most finfluencer enforcement relies on existing statutes.

Section 17(b): The Anti-Touting Rule

This is one of the most important pillars of SEC rules for financial influencers.

According to Securitieslawyer101, Section 17(b) of the Securities Act makes it illegal to promote a security without disclosing compensation.

That includes:

- Cash payments

- Free tokens or shares

- Referral commissions

- Affiliate income

This rule exists to stop fake “opinions” that are actually paid advertising. It plays a central role in modern regulated financial promotions. This is the rule used in high-profile celebrity cases such as Kim Kardashian and Paul Pierce.

Section 10(b) and Rule 10b-5: Fraud and Manipulation

These provisions target deceptive conduct and market abuse.

They apply when influencers:

- Spread false or misleading information

- Coordinate hype campaigns

- Profit from follower reactions without disclosure

This is where many pump-and-dump cases fall under financial influencer regulation.

Section 12: When Social Posts Become “Sales”

Courts have increasingly examined whether mass social media promotion can make an influencer a “statutory seller.”

Recent circuit court cases suggest that broad online promotion can trigger liability, even without one-to-one solicitation. This remains a fast-developing area within finfluencer regulation.

When Financial Influencers Become Investment Advisers

Not every finfluencer is an adviser.

But many cross the line without realizing it.

Under the Investment Advisers Act, a person is an adviser if they:

- Receive compensation

- Are engaged in the business

- Provide advice about securities

All three elements matter when assessing investment influencer regulation.

Why the “Publisher’s Exclusion” Often Fails

Some influencers argue they are just “media.”

That defense only works if the content is:

- Impersonal

- Bona fide (not promotional)

- Regular and general in circulation

Once content becomes paid, promotional, or performance-driven, the exclusion weakens. The SEC has challenged this argument before, including early internet cases such as “Tokyo Joe.”

The Marketing Rule and Paid Endorsements

Investment advisers using influencers must comply with Rule 206(4)-1.

This rule requires:

- Clear disclosure of compensation

- Disclosure of conflicts

- Written agreements with endorsers

- Supervision of influencer content

Failure to follow these rules is a recurring theme in financial influencer regulation cases.

FINRA Rules for Influencers Used by Broker-Dealers

When a brokerage firm hires influencers or benefits from their reach, FINRA rules for influencers become central to compliance.

This is where financial influencer regulation shifts from individual responsibility to firm-level accountability.

FINRA Rule 2210: Communications With the Public

FINRA Rule 2210 governs how broker-dealers communicate with the public. Influencer content falls under this rule when a firm:

- Pays for the content

- Helps prepare the content

- Explicitly or implicitly endorses the content

Under FINRA rules for influencers, communications must be:

- Fair

- Balanced

- Not misleading

This means no exaggerated returns.

No “guaranteed” outcomes.

No selective success stories without context.

Violations of Rule 2210 are among the most common failures in financial influencer regulation cases.

Supervision and Recordkeeping Failures

FINRA has repeatedly sanctioned firms for failing to supervise influencer marketing properly.

Common failures include:

- Not reviewing influencer posts before publication

- Not retaining influencer content

- Allowing misleading claims to circulate unchecked

Notable enforcement examples include M1 Finance and TradeZero America. These cases reinforce a key principle of regulated financial promotions: If a firm benefits from influencer marketing, the firm owns the compliance risk.

Crypto Promotions: Where Financial Influencer Regulation Accelerates Fast

Crypto has become the most aggressive enforcement zone for finfluencer regulation.

The reason is simple.

Hype spreads faster than disclosure.

The Howey Test and Token Risk

Many crypto tokens qualify as securities under the SEC’s Howey Test when they involve:

- An investment of money

- An expectation of profit

- Reliance on the efforts of others

Promoting unregistered securities violates Section 5 of the Securities Act and triggers SEC rules for financial influencers.

Common Crypto Promotion Failures

Regulators repeatedly observe the same mistakes:

- “100x” or “moon soon” language without risk disclosure

- Undisclosed affiliate links to exchanges or tokens

- Token promotion while secretly holding positions

- Coordinated hype via Discord or Telegram

Crypto content attracts regulators faster than almost any other category.

Real Enforcement Cases That Define Financial Influencer Regulation

If you want to understand regulation of financial influencers, enforcement actions tell the real story.

Regulators teach through consequences.

Celebrity Touting Cases: When Disclosure Fails

Kim Kardashian (2022)

The SEC charged Kim Kardashian for promoting EthereumMax on Instagram without disclosing that she was paid $250,000. She settled for $1.26 million in penalties, disgorgement, and interest.

Key lessons from this case:

- One post is enough

- Disclosure must be explicit

- Crypto is not exempt from regulated financial promotions

Paul Pierce (2023)

Paul Pierce promoted the same token while receiving over $244,000 in compensation without disclosure. The SEC charged him under Section 17(b).

Influence plus compensation triggers financial influencer regulation every time.

Pump-and-Dump Schemes: Where Enforcement Turns Aggressive

Some cases move beyond disclosure failures.

The $100 Million Pump-and-Dump Case

In 2022, the SEC and DOJ charged eight influencers for a coordinated pump-and-dump scheme involving stocks and crypto tokens. The group used Twitter and Discord to hype assets before selling at inflated prices.

This case highlighted:

- Coordinated online manipulation

- Private community abuse

- Market-moving influence without transparency

Even when criminal charges are challenged, civil liability remains severe under financial influencer regulation.

Firm-Level Failures: When Supervision Breaks Down

Investment influencer regulation does not stop with creators.

Firms carry responsibility.

TradeZero America (2024)

FINRA fined TradeZero America $250,000 for failing to review and retain influencer content promoting day trading and crypto strategies.

M1 Finance (2024)

FINRA fined M1 Finance $850,000 after influencers made misleading claims about margin lending. Over 39,000 accounts were opened through influencer campaigns without proper oversight.

These cases prove one rule of regulation of financial influencers:

“Marketing reach does not dilute compliance obligations.”

FTC Rules That Financial Influencers Often Overlook

Many influencers assume only the SEC matters.

That assumption is wrong.

FTC Endorsement Guides and Financial Content

The Federal Trade Commission enforces advertising truthfulness under the FTC Act.

FTC rules require:

- Clear disclosure of material connections

- Truthful, substantiated claims

- No misleading testimonials

The FTC fined Warrior Trading $3 million for misleading performance claims in financial marketing.

FTC enforcement often overlaps with regulation of financial influencers, especially where performance claims are involved.

State Laws and Cross-Border Exposure

Federal law is not the only risk layer. Many US states define investment advisers similarly to the SEC. Unregistered advice can trigger state enforcement.

After the FTX collapse, multiple celebrities faced lawsuits under Florida state law for promoting the platform without adequate disclosures.

Influence travels globally.

Liability follows.

Regulation of Financial Influencers: Compliance Checklist for 2026

This is where regulation of financial influencers becomes operational.

Below is a practical financial influencer compliance checklist based on SEC, FINRA, and FTC guidance.

Disclosure Basics

Always disclose:

- Paid sponsorships

- Affiliate links

- Token allocations

- Referral incentives

Disclosures must be:

- Clear

- Immediate

- Impossible to miss

Content Standards

To follow regulation of financial influencers, avoid:

- Guaranteed returns

- “Risk-free” language

- Selective success stories

- Unverifiable claims

Always include:

- Risk explanations

- Balanced outcomes

- Context for performance

Supervision for Firms

Firms must:

- Pre-approve influencer content

- Retain posts and videos

- Monitor ongoing activity

- Terminate non-compliant partners

FINRA expects written supervisory procedures.

Not informal reviews.

High-Risk Red Flags

Extra scrutiny is required for:

- Crypto and token promotions

- Day trading strategies

- Leverage and margin content

- Private Discord or Telegram groups

Stay Aligned With SEC and FINRA Rules

Financial influencer marketing requires strict adherence to disclosure, supervision, and recordkeeping standards. AWISEE helps brands structure influencer programs that comply with SEC and FINRA rules while maintaining marketing effectiveness.