The world of wealth management for the ultra-wealthy is a complex ecosystem, populated by established giants and rising stars. ach of the leading Wealth Management Firms brings a unique blend of history, expertise, and services to cater to the discerning needs of Ultra-High Net Worth Individuals (UHNWIs).

This article explores the top 10 Wealth Management Firms in 2024, highlighting their history, clientele, and key features tailored to the needs of UHNWIs.

AWISEE supports leading Wealth Management Firms with strategic PR and marketing campaigns tailored to UHNWIs. Explore how our solutions can elevate your brand.

Who is considered a UHNWI?

Wealth management caters to individuals across various financial tiers. At the top are Ultra-High-Net-Worth Individuals (UHNWIs) with a net worth exceeding $30 million. Their complex financial needs require specialized guidance from experienced Wealth Management Firms that understand the nuances of ultra-high-net-worth planning. due to the substantial assets involved. The threshold for UHNW status can vary slightly depending on the source.

Wealth management for UHNWIs goes beyond asset accumulation—it includes estate and tax planning, philanthropic strategies, and legacy preservation.

What is a wealth management firm?

Wealth Management Firms are specialized financial services companies that provide comprehensive financial planning and investment management services to individuals, families, and businesses. These Wealth Management Firms typically cater to high-net-worth and ultra-high-net-worth clients (HNW) and ultra high net worth (UHNW) clients, offering a range of services.

They act as strategic financial advisors, guiding clients through complex investment and planning decisions. They’ll develop a customized plan considering your goals, risk tolerance, and tax situation. They’ll also navigate the investment landscape, identify and mitigate risks, and help you plan for a secure future.

Read More About: The Best 5 Wealth Management Digital Marketing Agencies 20241. UBS (Switzerland, 1862)

- Head Office: Zurich, Switzerland

- Foundation Year: 1862

- Minimum Account Size: Varies (typically high)

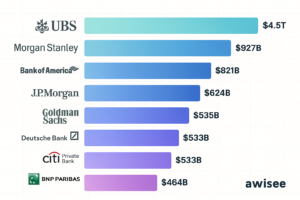

- AUM (Assets Under Management): $4.5 trillion USD

- Clientele: UHNWIs, Institutions

- Key Feature: Global reach and unparalleled expertise in complex financial instruments.

UBS boasts an extensive global network, offering a comprehensive suite of wealth management services. Their experience in navigating intricate financial markets makes them a top choice for UHNWIs with diversified and international holdings.

2. JPMorgan Private Bank (USA, 1799)

- Head Office: New York City, USA

- Foundation Year: 1799

- Minimum Account Size: $10 million USD

- AUM: $821 billion USD

- Clientele: UHNWIs, Families

- Key Feature: Long and distinguished history, with a focus on personalized service and building strong client relationships.

JPMorgan Private Bank leverages its rich history and global presence to provide UHNWIs with a tailored wealth management experience. Their emphasis on personalized service and long-term client relationships fosters trust and confidence.

3. Citi Private Bank (USA, 1812)

- Head Office: New York City, USA

- Foundation Year: 1812

- Minimum Account Size: Varies (typically high)

- AUM: $533 billion USD

- Clientele: UHNWIs, Families

- Key Feature: Extensive global network and access to investment banking expertise within the broader Citigroup ecosystem.

Citi Private Bank offers UHNWIs a powerful combination of wealth management services and the investment capabilities of Citigroup. Their global reach and diverse service offerings cater to complex financial needs.

4. Bank of America Private Bank (USA, 1928)

- Head Office: Charlotte, North Carolina, USA

- Foundation Year: 1928

- Minimum Account Size: $5 million USD

- AUM: $972 billion USD

- Clientele: UHNWIs, Families

- Key Feature: Strong wealth management platform with access to a broader range of banking services within Bank of America.

Bank of America Private Bank provides UHNWIs with a comprehensive wealth management solution, seamlessly integrated with everyday banking needs. Among Wealth Management Firms, their extensive resources and broad service offerings cater to those seeking a holistic financial management experience.

5. Morgan Stanley Private Wealth Management (USA, 1935)

💼 Need UHNW-Focused PR That Delivers?

AWISEE works with top-tier financial institutions to attract, engage, and convert ultra-high-net-worth clients through personalized PR, SEO, and authority marketing.

- Head Office: New York City, USA

- Foundation Year: 1935

- Minimum Account Size: Varies (typically high)

- AUM: $2.2 trillion USD

- Clientele: UHNWIs, Families

- Key Feature: Focus on entrepreneurial clients and growth-oriented investment strategies.

Morgan Stanley Private Wealth Management caters to UHNWIs with a focus on entrepreneurial ventures and growth-oriented investments. Their expertise aligns well with clients seeking to build and manage wealth through strategic investments.

6. Goldman Sachs Private Wealth Management (USA, 1869)

- Head Office: New York City, USA

- Foundation Year: 1869

- Minimum Account Size: Varies (typically high)

- AUM: $624 billion USD

- Clientele: UHNWIs, Families

- Key Feature: Deep expertise in complex financial markets and access to alternative investment opportunities.

Goldman Sachs Private Wealth Management draws on the firm’s experience in complex financial markets, offering UHNWIs access to a wider range of investment options beyond traditional assets. As one of the most recognized Wealth Management Firms, their focus on alternative investments caters to clients seeking diversification and potentially higher returns.

7. Credit Suisse Private Banking (Switzerland, 1856)

- Head Office: Zurich, Switzerland

- Foundation Year: 1856

- Minimum Account Size: Varies (typically high)

- AUM: $1.4 trillion USD

- Clientele: UHNWIs, Families

- Key Feature: Strong private banking tradition and a focus on emerging markets.

Credit Suisse Private Banking offers UHNWIs access to a longstanding private banking tradition with tailored services. Their strength in emerging markets makes them a trusted advisor for globally diversified portfolios.

8. BNP Paribas Wealth Management (France, 1848)

- Head Office: Paris, France

- Foundation Year: 1848

- Minimum Account Size: Varies (typically high)

- AUM: $464 billion USD

- Clientele: UHNWIs, Families

- Key Feature: Global presence and a strong focus on wealth transfer planning.

BNP Paribas Wealth Management offers a global wealth management platform with a particular strength in wealth transfer planning. Their expertise helps UHNWIs navigate the complexities of passing on wealth to future generations.

9. Deutsche Bank Wealth Management (Germany, 1870)

- Head Office: Frankfurt, Germany

- Foundation Year: 1870

- Minimum Account Size: Varies (typically high)

- AUM: $535 billion USD

- Clientele: UHNWIs, Families

- Key Feature: Strong European presence and a focus on customized wealth management solutions.

Deutsche Bank Wealth Management joins other top-tier Wealth Management Firms in delivering tailored strategies to UHNW families and entrepreneurs across Europe and beyond. Their focus on customization ensures strategies are aligned with individual client goals.

10. UBS Wealth Management Americas (USA, 1862 – Subsidiary of UBS)

- Head Office: New York City, USA (Subsidiary of UBS Switzerland)

- Foundation Year: 1862 (UBS)

- Minimum Account Size: Varies (typically high)

- Clientele: UHNWIs in the Americas

- Key Feature: Dedicated focus on the Americas market with a comprehensive suite of wealth management services.

UBS Wealth Management Americas, a subsidiary of the global giant UBS, caters specifically to UHNWIs in the Americas. They offer a comprehensive suite of wealth management services tailored to the unique needs and opportunities within the American market.

Finding the right wealth management firms: what to look for

- Define Your Goals: Start by getting clear on your financial goals. What do you want to achieve? Is it saving for retirement, managing investments, or planning your estate? Knowing your needs will help you find Wealth Management Firms aligned with your goals with the right expertise.

- Ask for Referrals: Talk to friends, family, or colleagues who have used a financial advisor. Positive recommendations from people you trust can be a great starting point. Professionals like accountants or lawyers might also have insights.

- Research Potential Advisors: Do your homework! Check the advisor’s credentials, experience, and any disciplinary history through regulatory bodies like the SEC and FINRA. Look for someone whose values and approach align with your goals.

- Schedule Consultations: Meet with potential advisors. Discuss your goals, understand their services and investment philosophy, and see if their approach resonates with you. Assess their communication style and if they seem knowledgeable and empathetic.

- Check References: Ask shortlisted advisors for client references. Talking to past or present clients can provide valuable insights into the advisor’s performance, reliability, and service quality.

- Understand Fees: Know how the advisor gets paid. Fees can significantly impact your overall costs. Ensure the structure (percentage, fixed fee, hourly rate) is transparent and aligns with your budget and goals.

- Trust Your Gut: Financial planning is a long-term partnership. Choose Wealth Management Firms you feel comfortable with—someone who understands your goals and genuinely wants to help you achieve them.

The world of Wealth Management Firms serving the ultra-wealthy is a complex and highly specialized space and specialized field. Wealth Management Firms serve as trusted advisors, delivering tailored strategies to help UHNWIs grow, protect, and preserve their wealth across generations. These services go beyond just investment management and encompass estate planning, tax strategies, philanthropic endeavors, and legacy building.

AWISEE is your partner in crafting a powerful PR and marketing strategy that attracts and retains high-net-worth clients.

We understand the unique challenges Wealth Management Firms face in attracting and retaining UHNW clients. Schedule a FREE consultation with AWISEE and discover how we can propel your wealth management firm forward!