Temu is no longer an experimental shopping app. These Temu Statistics confirm that it has become a global ecommerce force with hundreds of millions of users, billions in sales volume, and massive daily engagement.

What makes Temu Statistics especially important is speed. Within three years of launch, Temu moved from near-zero awareness to mainstream adoption across the United States, Europe, and several international markets. Temu user growth, Temu revenue 2025 projections, and Temu shopping app statistics all point in the same direction: Temu is now structurally embedded in global ecommerce behavior.

This article breaks down the most important Temu Statistics using verified data only. Each section focuses on usage, revenue, traffic, and business fundamentals to explain how Temu scaled so fast and what that scale actually looks like in numbers.

Win Visibility Inside a 400M+ User Marketplace

Temu’s explosive growth means visibility is no longer guaranteed. Ranking, promotion timing, and creative positioning now determine success. AWISEE helps sellers design Temu-specific marketing strategies that improve product discovery, click-through rates, and conversion performance.

Temu Users Statistics: Global User Base in 2025

Temu users statistics show one of the fastest user adoption curves in modern ecommerce history.

Monthly Active Users Worldwide

Data collected from Backlinko shows that:

- 416.5 million monthly active users worldwide (Q2 2025)

This figure represents global app usage and confirms Temu’s transition from early growth to large-scale adoption.

For historical context:

- Q1 2023: 23.4 million MAU

- Q1 2024: 167 million MAU

This growth explains why Temu growth statistics are now closely tracked by analysts and competitors.

Temu User Growth by Region

Temu user growth is not evenly distributed. Regional data explains where momentum is accelerating and where saturation is emerging.

United States

- 133.6 million monthly active users (Oct 2025)

- 28% year-over-year decline

The decline reflects market saturation, not collapse. The U.S. remains Temu’s single largest user market.

European Union

- 141.6 million monthly active users

- 74% year-over-year growth

Europe is now Temu’s fastest-growing region.

United Kingdom

- 13.1 million monthly active users

- 16.3% year-over-year growth

Regional Share of Global Users

Temu ecommerce data shows a clear shift away from U.S.-only dependency.

- European Union accounts for 34% of Temu’s global user base

This shift explains Temu’s increasing focus on European expansion.

Temu Shopping App Statistics: Downloads and Engagement

Temu shopping app statistics highlight massive top-of-funnel reach.

- 1 billion cumulative app downloads reached in Q2 2025

In 2024 alone:

- 484.31 million app downloads worldwide

Monthly Download Peaks

Temu growth statistics show downloads occurring in strong promotional waves.

Key monthly milestones:

- July 2024: 60 million downloads

- October 2024: 52.57 million downloads

- June 2025: 113 million downloads

Average Time Spent in the App

Engagement is one of Temu’s strongest signals.

- 21 minutes per day spent in the Temu app

For comparison:

- Amazon: ~10 minutes

- eBay: ~11 minutes

- AliExpress: ~11 minutes

Website Traffic and Usage

Temu business statistics also show strong web performance.

- 1.8 billion monthly website visits (September 2025)

- Up from 1.23 billion in September 2024

Another dataset collected from AMZ Scout shows:

- 2.11 billion website visits in June 2025

- U.S. share of traffic: 31.6%

- Average session duration: 9 minutes 2 seconds

Temu Revenue 2025 and Financial Scale

Temu financial statistics focus on GMV rather than net revenue, which is standard for marketplaces.

- $70.8 billion GMV in 2024

- Up from $18 billion in 2023

Quarterly GMV Breakdown

Temu revenue growth accelerated throughout 2024.

- Q1 2024: $11.3B

- Q2 2024: $13.5B

- Q3 2024: $18.0B

- Q4 2024: $28.0B

- Q1 2025: $13.18B

- Q2 2025: $14.52B

Alternative GMV Dataset (Early Growth)

Another verified dataset from Business of Apps shows earlier-stage scaling:

- 2022: $290M

- H1 2023: $2.896B

- H2 2023: $12.26B

- H1 2024: $21.6B

Orders and Average Order Value

Temu processed:

- 412.3 million orders in 2023

Q4 2023 alone:

- 170 million orders

- 14.8× increase vs Q4 2022

Average Order Value (AOV)

Temu financial statistics show steady basket growth.

- Q4 2022: $24.0

- Q4 2023: $38.9

- 62.08% year-over-year increase

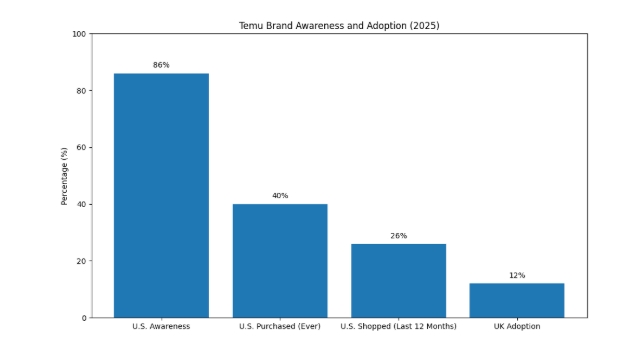

Brand Awareness and Adoption

Temu business statistics confirm mainstream recognition.

- 86% of U.S. adults are aware of Temu

- 4 in 10 U.S. adults have made a purchase

Adoption rates:

- U.S.: 26% shopped on Temu in last 12 months

- UK: 12% adoption

Market Share and Competition

U.S. Discount Retail Market Share is as follows:

- 11% market share

- 17% market share

The difference reflects category definitions and methodology, not an error.

Seller Ecosystem and Product Scale

Temu business statistics show rapid supply-side expansion.

- ~100,000 U.S. sellers

- ~200,000 international sellers

Product depth:

- ~10 million SKUs globally

- ~2 million SKUs in the U.S.

Marketing Spend and Strategy Shift

Take a look at the following numbers:

- $3 billion marketing spend in 2023

- $2 billion spent on Meta Ads

In 2025:

- Google Shopping ads halted in the U.S.

- Facebook Ads reduced

- European ad spend increased:

- France: +40% MoM

- UK: +20% MoM

What Temu Statistics Indicate for 2026

Temu Statistics make several trends clear:

- Temu user growth is global, not U.S.-dependent

- Temu revenue 2025 remains strong despite reduced U.S. advertising

- Engagement metrics outperform traditional ecommerce apps

- Competitive pressure will intensify as scale increases

Temu is no longer a short-term phenomenon. Based on current Temu Statistics, it is now a structural player in global ecommerce.

Scale Faster as Temu Competition Intensifies

As per AWISEE, “Temu operates a hybrid creator system.” AWISEE supports brands with scalable Temu marketing services that adapt to regional demand, shifting ad spend, and evolving user behavior—before competition catches up.