Creator economy data shows that digital marketing has entered a new phase. Brands are no longer testing creator partnerships on the sidelines. They are restructuring their budgets around creators as primary media channels. This change did not happen overnight. It developed as consumer attention shifted away from traditional advertising and toward trusted individuals online.

Creator economy data highlights how advertising spend continues to rise even as consumer confidence tightens. That contrast defines the environment going into 2026. Consumers still rely on creators for discovery, validation, and guidance. Yet they are spending more carefully than before. This tension forces brands to rethink how creator-led advertising actually works. It is no longer enough to generate reach alone. Campaigns must balance credibility, value, and performance.

Creator economy data provides the clearest lens into how these forces interact. Understanding that interaction is essential for marketers planning for 2026. This article discusses rising ad spend & shifting consumers in 2026.

Creator Economy Data Shows Advertising Spend Entering a Structural Phase

Creator economy data confirms that advertising growth is no longer seasonal. It is structural. According to inbeat agency, “As of 2025, the creator economy is valued at $250–$480 billion.”

U.S. creator advertising spend more than doubled in just three years. Brands shifted money away from traditional media. They redirected budgets toward creators who control attention and trust.

Discover the Right Creators for Your Niche in 2026

Creator-led advertising only works when the creator truly aligns with your audience, category, and buying intent. AWISEE helps brands identify, evaluate, and partner with niche-relevant creators who influence real decisions—not just generate reach.

U.S. Creator Advertising Growth

Data collected by Net Influencer shows that:

- 2021: $13.9 billion

- 2024: $29.5 billion

- 2025 (projected): $37 billion

This growth reflects a clear reallocation of marketing budgets. IAB data cited in the same report shows that creators now function as primary distribution channels across retail, consumer goods, and entertainment. That marks a fundamental change. Creators are no longer an add-on. They are infrastructure inside creator-led advertising systems.

Creator-Led Advertising Replaces Traditional Discovery Channels

Discovery used to happen on search engines. Then social feeds took over. Now creators sit at the top.

Creator economy data shows that influencer-led content continues to drive discovery even when consumers plan to spend less. This creates a contradiction that brands must understand. People trust creators. But they buy more selectively.

This tension directly affects campaign planning. Creator economy insights suggest that discovery remains strong, while conversion requires clearer value signals. In 2026, creator-led advertising succeeds when it respects this reality.

Creator Economy Ad Spend Grows While Consumers Pull Back

Rising ad budgets do not mean rising consumer spend. Creator economy ad spend keeps increasing, but consumer confidence does not move at the same pace.

Younger audiences still rely heavily on influencers. Yet they expect to reduce spending.

Gen Z Holiday Spending Behavior

- 74% of Gen Z rely on influencers and social platforms for inspiration

- Gen Z expects to reduce holiday spending by 34% year over year

This data shows a clear split:

- Discovery behavior remains strong

- Discretionary spending tightens

Creators still guide decisions. But price sensitivity shapes outcomes. Creator economy statistics 2026 suggest that performance-based models matter more as consumers become selective.

Value and Trust Redefine Purchasing Decisions

Millennial parents behave differently than Gen Z. Creator economy data highlights this shift clearly.

Millennials prioritize:

- Dependability

- Trustworthiness

- Clear value

The Harris Poll’s QuestBrand study, referenced in the same report, shows that creators still influence purchasing decisions. But messaging must evolve. Flashy promotions lose effectiveness. Practical storytelling gains importance. This explains why creator marketing ROI 2026 depends more on credibility than hype.

Serialized Content Drives Higher Engagement Across Platforms

According to AWISEE, “In 2025, the creator economy is more competitive than ever, and creators are searching for dependable ways to build recurring revenue. ” Content structure is changing across the creator economy.

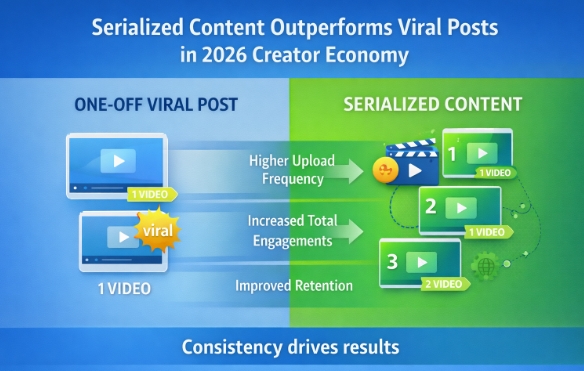

Creators who publish episodic or repeatable formats perform better. Shorthand Studios analyzed serialized creator content across TikTok, Instagram, and YouTube. The results show consistent upward movement.

Serialized Content Performance Trends

- Higher upload frequency

- Increased total engagements

- Higher total views

Exact numerical increases were not disclosed. But the trend direction is clear. Creators who build recurring characters, defined universes, or thematic series produce more content and receive more interaction. This signals a shift away from one-off viral posts.

Structured Storytelling Shapes Creator Economy Trends 2026

Short-form video is not becoming shorter. It is becoming more structured.

Creator economy trends 2026 show that:

- Series outperform isolated clips

- Familiar formats improve retention

- Audiences reward consistency

This shift benefits long-term brand partnerships. Episodic content allows repeated exposure without audience fatigue. Creator economy growth increasingly depends on structured storytelling rather than random virality.

Platform Consumption Shifts Redefine Creator Strategy

Platforms are not standing still. Consumption patterns are changing fast, and creator economy data reflects this evolution clearly.

YouTube shows the most visible transformation.

YouTube Long-Form Growth

- Videos 20+ minutes

- 22% of uploads in 2020

- 47% of uploads in 2024

- View share

- 20% in 2020

- 43% in 2024

Long-form content now commands a much larger share of attention. According to the same analysis:

- YouTube surpasses cable TV among adults aged 18–49

- YouTube exceeds Netflix in total TV screen time

This explains why creators increasingly treat YouTube as a primary platform rather than a support channel.

Instagram Becomes the First Step in Campaign Planning

Platform hierarchy has changed. Creator economy data shows that brands now plan campaigns differently than before.

Instagram has become the starting point.

Underscore Talent’s internal campaign data shows that most brand partnerships now launch on Instagram first. TikTok and YouTube Shorts follow later. This sequencing reflects how brands prioritize visibility and credibility.

Campaign Sequencing Shift in 2025

- Instagram used as the primary launch platform

- TikTok and YouTube Shorts used as secondary placements

This shift matters. Instagram now anchors campaigns. Other platforms extend reach. Creator-led advertising strategies no longer treat platforms equally.

Affiliate Commerce Expands as Performance Becomes the Priority

Affiliate commerce continues to grow, even as consumer spending tightens. Creator economy data shows that brands want measurable outcomes.

Retailers are no longer relying only on third-party affiliate networks. Many now build proprietary creator programs. This reflects a deeper focus on performance-driven creator economy growth.

Major U.S. retailers expanding or launching creator-focused affiliate programs include:

- Walmart

- Sephora

- e.l.f. Beauty

At the same time, creators continue to use established affiliate platforms:

- Amazon Storefronts

- LTK

- ShopMy

- MagicLinks

Transaction totals were not disclosed. But increased participation from both brands and creators signals confidence in affiliate-led conversions. This directly supports higher creator marketing ROI 2026, especially in cautious spending environments.

Creator Economy Insights Reveal a Gen X Spending Blind Spot

Most creator campaigns still focus on Gen Z and Millennials. Creator economy data shows that this focus creates a mismatch.

Gen X is highly active on social platforms. Yet brands rarely prioritize them.

Gen X Social Media Presence

- 92% of Gen X users engage with social media daily

- Gen X represents 28% of TikTok’s user base

This group also holds strong spending power.

Future Consumer Spending Projection is as follows:

- Consumers aged 55+ expected to drive over $15 trillion in annual spending by 2030

Despite this, less than 10% of marketing budgets target this demographic. Creator economy insights show this as one of the largest inefficiencies heading into 2026.

AI Expands Across Core Creator Production Workflows

AI adoption is no longer experimental. Creator economy data shows that AI now plays a practical role in daily creator work.

Creators increasingly use AI for:

- Video editing

- Dubbing and translation

- Music composition

- Graphic design

- Clipping and pre-visualization

The report also notes increased use of AI-generated animation, especially in children’s YouTube content. Viewership numbers were not shared. But adoption clearly increased.

AI does not replace creativity. It removes friction. This allows creators to publish more consistently and scale production without large teams.

Creator-Owned Channels Reduce Algorithm Dependency

Creators are building long-term stability. Creator economy data shows growing interest in audience ownership.

Instead of relying only on feeds, creators increasingly use direct communication channels. This reflects long-term thinking inside creator economy trends 2026.

Growing creator-owned channels include:

- Newsletters

- Substack-style publishing

- Instagram broadcast channels

These tools offer:

- Direct audience access

- Predictable reach

- Better monetization control

This reduces platform risk and strengthens creator leverage in brand negotiations.

Offline Events Re-Enter Creator Campaigns

Creator marketing is no longer fully digital. Creator economy data shows increased use of offline activations. Brands now blend physical experiences with online influence. Common offline formats include:

- Tours

- Fan meet-ups

- Marathons

- Live brand activations

Attendance figures were not disclosed. But frequency increased. Offline events add trust. They deepen loyalty. They extend creator-led advertising beyond screens.

Creator Economy Data in 2026 Shows a Clear Direction

The pattern inside creator economy data is consistent.

- Creator economy ad spend continues to rise

- Consumers spend more cautiously

- Creators remain central to discovery

- Performance, trust, and value matter more than hype

Creator economy statistics 2026 show that growth is not slowing. It is maturing.

Brands that understand shifting consumer behavior will win. Those that rely on old assumptions will struggle. In 2026, creator-led advertising succeeds when it balances attention with restraint, storytelling with value, and reach with credibility.

Match Your Brand With High-Impact Niche Creators

Choosing creators based on follower count alone no longer delivers ROI. AWISEE uses data, audience relevance, and category insight to help brands collaborate with creators who convert trust into measurable outcomes.