Streaming has changed how the world watches entertainment. But sports remains different. In 2025, live sports streaming continues to defy on-demand behavior. Fans want games live. They want reliability. And they want access across devices. This demand has pushed platforms into forming the Biggest Streaming Partnerships seen so far. These partnerships affect pricing, bundling, and long-term platform design. Understanding these relationships is critical to understanding the sports streaming market itself.

The streaming industry is crowded. But sports still cuts through the noise. In 2025, live sports streaming has become the most powerful retention tool in digital entertainment. While movies attract viewers, sports keeps them loyal. This reality explains why the Biggest Streaming Partnerships are reshaping the industry.

This article examines live sports streaming platforms, the role of digital sports broadcasting, and why sports streaming partnerships now sit at the center of the streaming economy.

Turn Live Sports Audiences Into Brand Growth

If you want to grow your brand through live sports streamers, AWISEE helps you design influencer marketing strategies that reach highly engaged fans at the exact moments that matter most.

The Streaming Industry in 2025: Scale Comes First

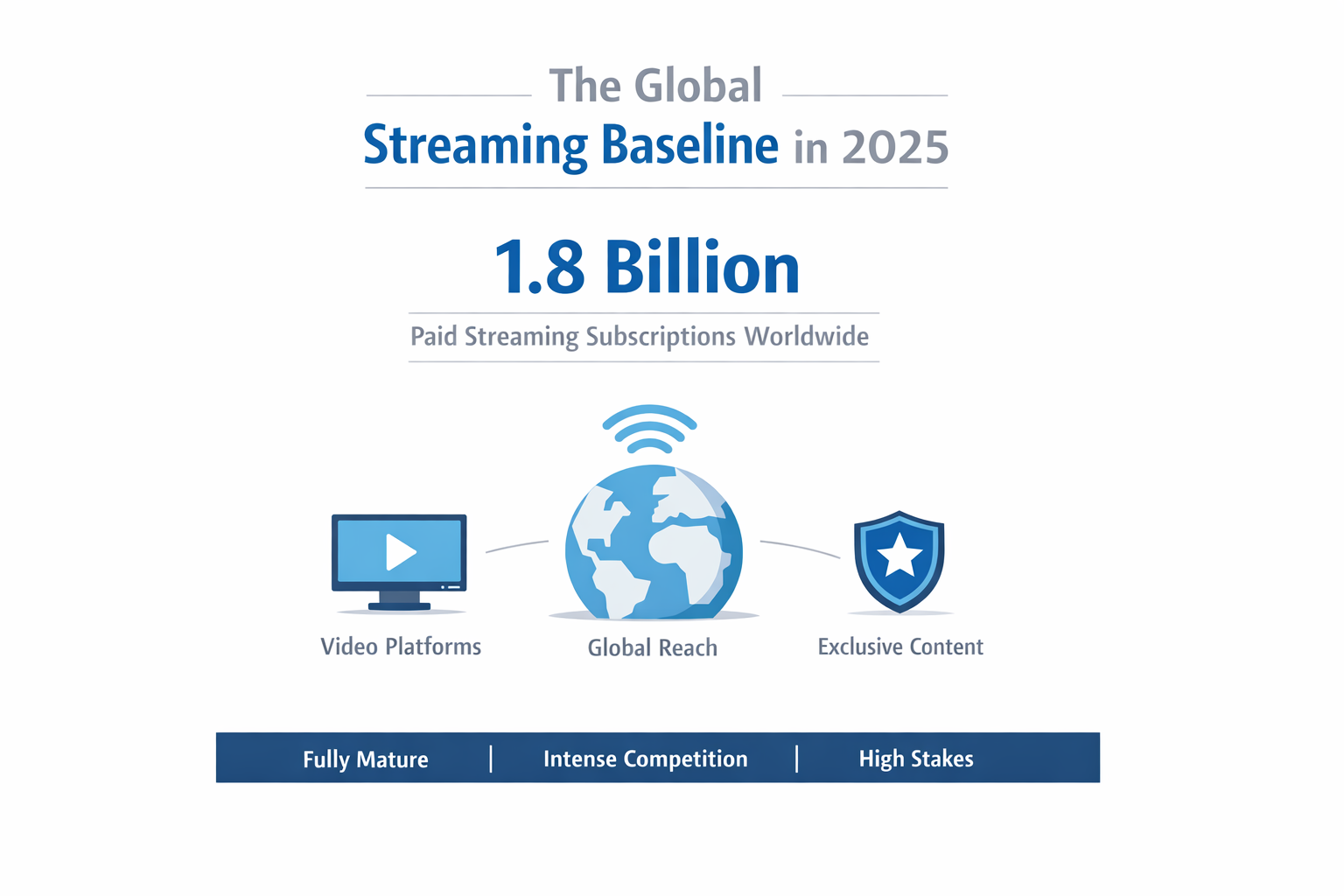

Before analyzing live sports streaming platforms, one number sets the context.

As per Virtina AI, there are 1.8 billion paid video streaming subscriptions worldwide. This single statistic explains why the Biggest Streaming Partnerships matter so much.

Streaming is no longer early-stage. It is fully mature. Competition is intense.

Only a small group of platforms control:

- Subscriber relationships

- User data

- Content discovery

- Pricing power

Sports rights now sit directly inside this power struggle. This is why the sports streaming market behaves differently from entertainment-only streaming.

Why Live Sports Is Still Different From Movies and Series

Most streaming content is flexible. Sports is not. Live sports streaming creates:

- Habit

- Appointment viewing

- Emotional attachment

- Lower churn behavior

That is why the sports streaming market does not follow standard OTT rules. Live sports remains the last true holdout of linear television, even as digital adoption accelerates globally.

Biggest Streaming Partnerships: Platforms With Structural Advantage

The Biggest Streaming Partnerships in sports usually form around platforms that already have scale. Subscriber volume matters. Global reach matters. Bundling capability matters.

Netflix: The Scale Benchmark (Even Without Heavy Sports)

Netflix remains the reference point for the entire streaming industry. Come to light reported approximately 282.7 million subscribers worldwide as of 2024.

Netflix is not a major live sports buyer today. But its scale influences every sports streaming partnership negotiation. Netflix defines:

- What global reach looks like

- How pricing expectations are set

- How loyalty benchmarks are measured

Even sports-first platforms compare themselves to Netflix-style scale.

Amazon Prime Video: Sports + Bundling Power

Amazon Prime Video operates under a different logic. It combines:

- Entertainment

- Shopping

- Logistics

- Live sports streaming

Prime Video has over 230 million subscribers worldwide. Live sports already sits inside Amazon’s ecosystem. Bundling reduces churn in ways standalone online sports streaming services cannot easily replicate. This makes Amazon one of the strongest forces in sports streaming partnerships.

Disney+: The ESPN+ Advantage

Disney+ is not just a streaming app. It is part of a broader media ecosystem. Disney+ reached 158.6 million subscribers by late 2024.

More importantly, Disney integrates ESPN+ directly into its platform strategy. This creates a seamless bridge between entertainment and live sports streaming platforms.

Sports fans do not need to exit the ecosystem. That matters.

Live Sports Streaming 2025: Platforms Built for Sports Fans

Some platforms are generalists. Others are sports-native.

In live sports streaming 2025, sports-native platforms are non-negotiable.

ESPN+: Sports as a Core Product

ESPN+ was designed specifically for sports content. It had over 25 million subscribers by 2024. ESPN+ focuses on:

- Live games

- Sports documentaries

- Exclusive league coverage

This makes ESPN+ structurally different from entertainment-first platforms.

DAZN: The Global Sports Specialist

DAZN is another major force in the biggest sports streaming partnerships ecosystem.

It focuses heavily on:

- Boxing

- MMA

- International sports rights

DAZN reported 16 million subscribers globally. DAZN proves that sports-only models can still succeed when the audience is highly engaged.

Hulu + Live TV: The Bundle That Keeps Sports Alive

Hulu blends:

- On-demand streaming

- Live television

- Sports access

Hulu reached 52 million subscribers by late 2024. Hulu + Live TV remains a critical gateway for major U.S. sports leagues.

Why Sports Streaming Partnerships Are Structuring the Market in 2025

Sports rights are not just content deals anymore. They shape how platforms are built. In 2025, the Biggest Streaming Partnerships are influencing:

- Product design

- Pricing strategy

- Subscriber retention

- Platform architecture

That is why sports streaming partnerships sit at the center of strategic planning.

The Three Core Partnership Models

In the current sports streaming market, partnerships usually follow three structures:

- Bundled access: Sports included inside a larger subscription

- Standalone sports platforms: Dedicated online sports streaming services

- Hybrid models: Base subscription plus paid sports add-ons

Each model exists because live sports streaming behaves differently from entertainment. This structural reality defines the future of live sports streaming.

Sports Streaming Partnerships: How Deals Are Structured in 2025

In 2025, sports streaming partnerships are no longer simple licensing agreements. They are strategic alliances designed around audience behavior, retention economics, and platform architecture.

Deals are structured to protect long-term subscriber value rather than short-term viewership spikes. This shift reflects the increasing cost and importance of live sports rights within mature streaming ecosystems.

Partnership Model #1: Sports Inside Large Subscription Bundles

This is currently the most powerful model. Sports content is not sold alone. It is embedded inside a broader offering.

Examples include:

- Amazon Prime Video bundling sports with shopping and entertainment

- Disney+ integrating ESPN+ into its core ecosystem

- Hulu combining on-demand streaming, live TV, and sports access

This model strongly favors platforms with scale. And scale drives the Biggest Streaming Partnerships.

Pricing and Packaging: Why Sports Drives Subscription Strategy

Sports changes how streaming services price their products.

- Netflix’s ad-supported tier costs $6.99 per month

- Disney’s bundled offering is priced at $14.99

These figures matter because they anchor expectations across the industry. In most live sports streaming platforms, sports access appears inside premium bundles.

Sports is rarely cheap. But in the sports streaming market, it is rarely optional.

The Sports Streaming Market: Subscriber Scale vs Sports Utility

In 2025, sports streaming partnerships are no longer simple licensing agreements. They are strategic alliances designed around audience behavior, retention economics, and platform architecture.

Deals are structured to protect long-term subscriber value rather than short-term viewership spikes. This shift reflects the increasing cost and importance of live sports rights within mature streaming ecosystems.

Subscriber Giants

These platforms dominate global reach:

- Netflix: 282.7 million subscribers

- Amazon Prime Video: 230+ million subscribers

- Disney+: 158.6 million subscribers

They may not own every sports right. But their scale gives them negotiation leverage in the Biggest Streaming Partnerships.

Sports-First Platforms

These platforms dominate specific fan segments:

- ESPN+: 25+ million subscribers

- DAZN: 16 million subscribers

They are built for loyal fans, not casual viewers. This is why many of the biggest sports streaming partnerships combine:

- Sports specialists supplying rights

- Large platforms supplying distribution

Digital Sports Broadcasting: What Really Matters in 2025

Digital sports broadcasting in 2025 is judged less by raw viewership and more by audience quality. Platforms focus on retention, satisfaction, and long-term subscription durability. Live sports content is evaluated based on how it strengthens platform loyalty, not just how many people tune in.

Loyalty Is the New Currency

According to Vitrina, Netflix achieved an ACSI customer satisfaction score of 84 out of 100 in 2025. High satisfaction signals:

- Strong user experience

- Lower churn risk

- Greater pricing flexibility

Sports leagues pay attention to these metrics when selecting partners.

AI, Budget Control, and Sports Rights Economics

Streaming economics changed significantly in 2025. Platforms are no longer chasing growth at any cost.

- Amazon reduced 25% of its 2024 content budget using AI forecasting

This affects sports streaming partnerships in two ways:

- Rights deals face stricter evaluation

- Data-driven forecasting influences bidding strategies

Sports rights remain premium. But they must justify their cost inside the digital sports broadcasting ecosystem.

What the Future of Live Sports Streaming Looks Like

The future of live sports streaming is defined by alignment rather than domination. No single platform will own sports entirely. Instead, the market will be shaped by partnerships that balance scale, specialization, and regional distribution.

The future of live sports streaming is not about one dominant platform. It is about alignment. In 2025, the Biggest Streaming Partnerships are built around:

- Scale (subscriber reach)

- Specialization (sports-first platforms)

- Bundling (entertainment + sports)

- Distribution (regional and aggregator partners)

Live sports will remain one of the most expensive and emotionally powerful content categories in digital media. Its non-substitutable nature ensures it will continue to command strategic priority, shaping platform design, pricing, and partnerships for years to come.

Win Attention During Live Sports Moments

Live sports streaming creates unmatched engagement. AWISEE helps brands partner with sports streamers and creators to turn live moments into measurable brand impact.