Understanding Apple Pay statistics is essential for anyone tracking the future of digital payments. Apple Pay has grown quietly, without dramatic pivots or viral campaigns. Instead, Apple Pay adoption has followed behavior. Users tap, repeat, and trust the system. That trust compounds.

Apple Pay statistics tell a story of consistency rather than disruption. Since its early days, Apple Pay user growth has followed Apple’s ecosystem rather than chasing standalone dominance. In 2026, Apple Pay usage spans physical retail, ecommerce, subscriptions, and transit systems.

In this report, Apple Pay statistics are used to analyze how many people use Apple Pay, where they use it, and why they stay. From Apple Pay market share to Apple Pay wallet expansion, every data point reveals a deeper pattern. This article looks beyond surface numbers and focuses on usage depth.

Outperform Other Apple Pay Stores in Search

Millions of Apple Pay stores compete for attention. AWISEE helps your brand stand out by earning authoritative links and ranking your companies where buyers actually search.

Apple Pay Statistics Snapshot (2026)

Before going deeper, it helps to look at scale. Apple Pay does not exist in isolation. Its growth is tightly linked to Apple’s broader ecosystem.

Key Apple Pay Statistics at a Glance

Data collected from Cropink shows that:

- Apple Pay had 785 million global users by 2024

- Apple Pay operates in 78 markets worldwide

- Apple Pay is supported by 11,000+ banks and network partners

- 85% of U.S. retailers accept Apple Pay

- Apple Pay holds 54% of U.S. in-store mobile wallet usage

- Apple Pay processes 14.2% of online consumer payments

These Apple Pay statistics reveal an important truth. Apple Pay user growth is not driven by hype. It is driven by acceptance, convenience, and habit formation.

Number of Apple Pay Users: Global Growth and U.S. Scale

The number of Apple Pay users worldwide is substantial.

Apple Pay Global User Count

By 2024, Apple Pay had reached 785 million active users globally. This places Apple Pay among the largest digital payment platforms in existence.

However, Apple Pay user growth was not always smooth. Between 2014 and 2021, Apple Pay adoption progressed slowly. The real acceleration came later. According to the data, Apple Pay adoption increased by 41% between 2022 and 2024.

This shift marks Apple Pay’s transition from experimentation to habit.

Apple Pay Active Users Over Time

Apple Pay user growth over time tells a clear story:

- 2017: 337 million users

- 2018: 389 million users

- 2019: 441 million users

- 2020: 507 million users

- 2021: 631 million users

- 2022: 701 million users

- 2023: 744 million users

- 2024: 785 million users

Most recent Apple Pay user growth did not come from new Apple customers. It came from existing iPhone users finally activating Apple Pay.

Apple Pay Users in the United States

The U.S. remains Apple Pay’s most important market.

According to SQ Magazine, by 2025:

- Apple Pay reached 60–65 million active U.S. users

- That equals nearly one in four U.S. consumers

Looking ahead:

- Apple Pay is projected to reach 75.4 million U.S. users by 2030

This is not explosive growth. It is behavioral growth. And behavioral growth tends to last.

Apple Pay Adoption: What Drives Growth (And What Slows It)

One Apple Pay statistic explains adoption better than any other.

Merchant Acceptance Is the Core Driver

85% of U.S. retailers now accept Apple Pay. When Apple Pay is accepted everywhere:

- Users stop thinking

- They stop comparing

- They simply tap

Data shows that 58% of Apple Pay adoption growth is directly linked to increased merchant acceptance. This explains why Apple Pay adoption accelerated after 2022.

Eligible Users vs. Actual Apple Pay Usage

Here is a counter-intuitive Apple Pay statistic.

Despite widespread adoption:

- Over 90% of eligible iPhone users have never used Apple Pay for in-store purchases

This does not mean Apple Pay is failing. It means Apple Pay usage is deep, not universal. A smaller group uses it frequently. Others have not formed the habit yet.

Transit and Daily Use Cases Matter

Apple highlights transit usage as a turning point. In cities like Tokyo, millions of people tap Apple Pay daily to commute.

Daily repetition builds muscle memory. Once that habit forms, Apple Pay becomes the default everywhere else.

Apple Pay Usage: In-Store vs Online Behavior

Apple Pay dominates physical retail payments among mobile wallets.

In-Store Apple Pay Usage

- Apple Pay controls 54% of in-store mobile wallet usage in the U.S.

- Apple Pay accounts for 5.6% of all U.S. in-store purchases

This dominance is structural, not accidental.

Apple Pay is:

- Faster at checkout

- Secured by Face ID or Touch ID

- Accepted by most merchants

Online and In-App Apple Pay Usage

Apple Pay digital payments are also growing online.

- Apple Pay processes 14.2% of online consumer payments

- 36% of U.S. consumers have used Apple Pay for online purchases

- Online Apple Pay usage is up 21% since 2018

This growth is driven by:

- One-tap checkout

- Stored credentials

- Deep in-app integration

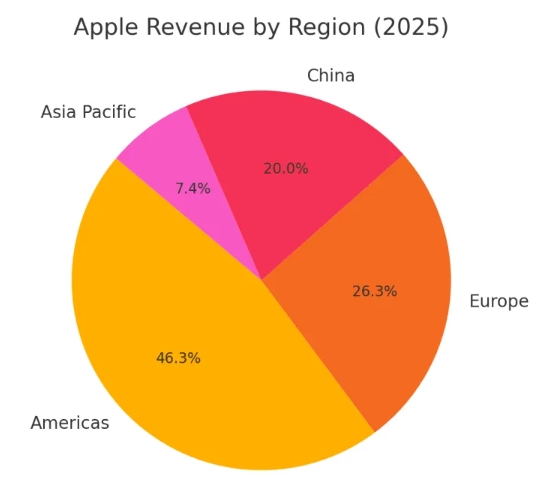

Apple Pay Market Share in Digital Payments

Apple Pay market share in physical retail is dominant.

U.S. In-Store Mobile Wallet Market Share

- Apple Pay: 54%

- All other wallets combined: 46%

Apple Pay is not just competing. It is defining the in-store mobile payment experience.

Online Payment Market Share Comparison

Globally, online payment market share looks different.

- Apple Pay market share: 14.22%

- PayPal: 47.43%

- Stripe: 8.09%

Apple Pay wins where biometrics and devices matter. PayPal wins where account logins dominate.

Apple Pay Demographics: Who Uses Apple Pay the Most

Apple Pay statistics show that adoption is not evenly distributed.

Apple Pay Usage by Generation

Some age groups use Apple Pay far more than others. And those differences matter when analyzing Apple Pay 2026.

Here is how Apple Pay usage breaks down by generation in the United States:

- Gen Z: 8.8% use Apple Pay

- Millennials: 4.0% use Apple Pay

- Gen X: 1.1% use Apple Pay

- Baby Boomers & Seniors: 0.8% use Apple Pay

These Apple Pay statistics highlight a clear trend. Apple Pay adoption is strongest among younger users. That means Apple Pay user growth is weighted toward the future, not the past.

Apple Pay vs PayPal by Generation

Apple Pay statistics become even more interesting when compared with PayPal.

- Millennials still prefer PayPal (14.4%) over Apple Pay (4.0%)

- Gen Z uses Apple Pay (8.8%) more than older generations

- PayPal adoption is more evenly spread across age groups

Apple Pay does not need to dominate every demographic. Winning Gen Z is often enough to shape long-term Apple Pay digital payments behavior.

Apple Pay in Ecommerce and Subscriptions

Apple Pay statistics confirm that the platform is no longer limited to physical checkouts.

Apple Pay Online Payment Presence

Apple Pay digital payments are now common online.

Key Apple Pay usage metrics:

- 14.2% of global online consumer payments go through Apple Pay

- Apple Pay is supported on millions of websites and apps

- 36% of consumers have used Apple Pay online

Once Apple Pay is saved as a default option, switching becomes unlikely. That is how payment habits form.

Apple Pay and Subscription Payments

Subscriptions amplify Apple Pay usage.

- 44% of subscription services now offer Apple Pay as a preferred payment method

- In-app purchases via Apple Pay increased 26% year-over-year

Recurring payments turn Apple Pay wallet usage into a routine, not a choice.

Revenue, Fees, and Apple Pay Economics

Apple does not disclose Apple Pay revenue directly.

How Much Revenue Does Apple Pay Generate?

Apple Pay statistics provide reliable estimates.

- Apple Pay generated approximately $1.9 billion in revenue in 2022

- This revenue came from $6 trillion in global transaction volume

That revenue represents only 0.5% of Apple’s total revenue.

This confirms Apple Pay’s role. It is not a standalone profit engine. It is an ecosystem anchor.

How Apple Pay Makes Money

Apple Pay monetizes quietly.

Revenue sources include:

- Fees from financial institutions

- A small percentage of credit card transactions

- In-app purchase processing

- Apple Card–related revenue streams

Even small margins matter at global scale.

Trust, Security, and Customer Satisfaction

Apple Pay statistics around trust are unusually strong.\

Why Consumers Trust Apple Pay

Apple Pay security features include:

- Card numbers are never shared with merchants

- Each transaction uses a unique token

- Authentication relies on Face ID, Touch ID, or passcode

This design reduces fraud and increases confidence.

Apple Pay Customer Satisfaction

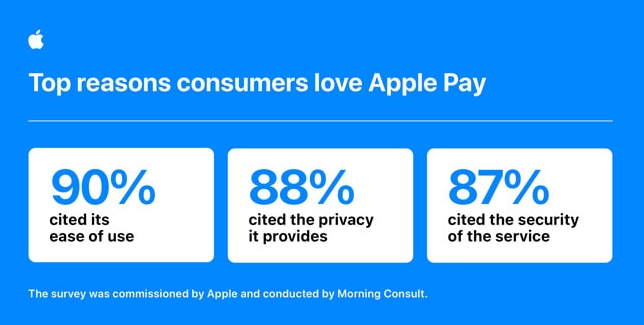

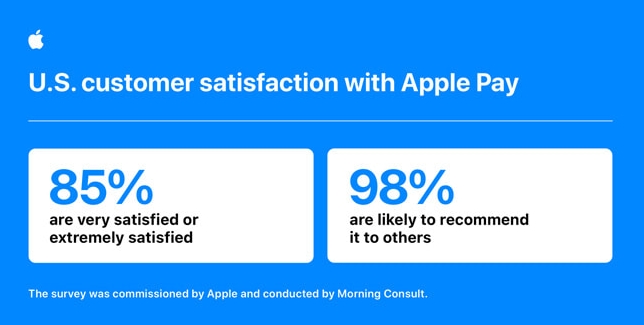

Apple Pay statistics around satisfaction are clear.

- 90% cite ease of use

- 88% cite privacy protection

- 87% cite security

- 85% of U.S. users are very or extremely satisfied

- 98% are likely to recommend Apple Pay

These figures explain why Apple Pay adoption continues without aggressive marketing.

Apple Pay Wallet Expansion and New Payment Features

Apple Pay wallet functionality is expanding.

Buy Now, Pay Later (BNPL) Integration

With iOS 18:

- Users can access BNPL options directly at checkout

- Partners include Affirm (U.S.), Monzo Flex (U.K.), and Klarna

- BNPL works online and in-app

This positions Apple Pay inside one of the fastest-growing digital payment categories.

Rewards and Browser-Based Payments

Apple Pay wallet updates also include:

- Rewards redemption at checkout

- Apple Pay usage on third-party browsers

- QR-based payment authorization via iPhone or iPad

These features expand Apple Pay adoption beyond Apple-only environments.

Apple Pay Competition: Who Is Apple Pay Competing With?

Apple Pay market share remains strong but competitive.

U.S. Digital Wallet Market Share

In the U.S.:

- PayPal: 35% market share

- Apple Pay: 20% market share

- Venmo: 16% market share

Apple Pay leads in mobile-first, in-store environments. PayPal still dominates account-based online payments.

Mobile Wallet Platform Market Share

Across mobile wallet platforms:

- Google Wallet: 48.15%

- Apple Pay: 22.29%

- Coinbase Wallet: 19.13%

Apple Pay wins on hardware integration. Google Wallet wins on platform reach.

Regulatory and Market Shifts Affecting Apple Pay

Apple Pay statistics must be viewed through a regulatory lens.

NFC Access and Regulation

In Europe:

- The EU Digital Markets Act requires Apple to open NFC access

- Third-party wallets will gain deeper access

This increases competition. But habit remains Apple Pay’s strongest defense.

Apple Pay statistics reveal a consistent pattern. Apple Pay is not chasing viral growth. It is building repeatable behavior.

In Apple Pay 2026, Apple Pay is no longer optional. It is embedded.

Turn Apple Payments Into a Conversion Advantage

Fast checkout improves conversion—but only if customers arrive first. AWISEE helps Apple pay stores increase qualified traffic through SEO and link building that drives purchase-ready visitors.